5.6. Black, white and loyalty lists¶

5.6.1. Overview¶

- Manager BWL

- Merchant BWL

- Processor BWL

- Gate BWL

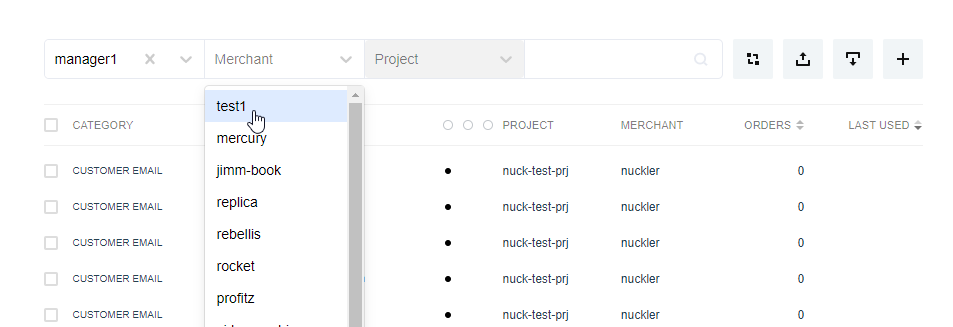

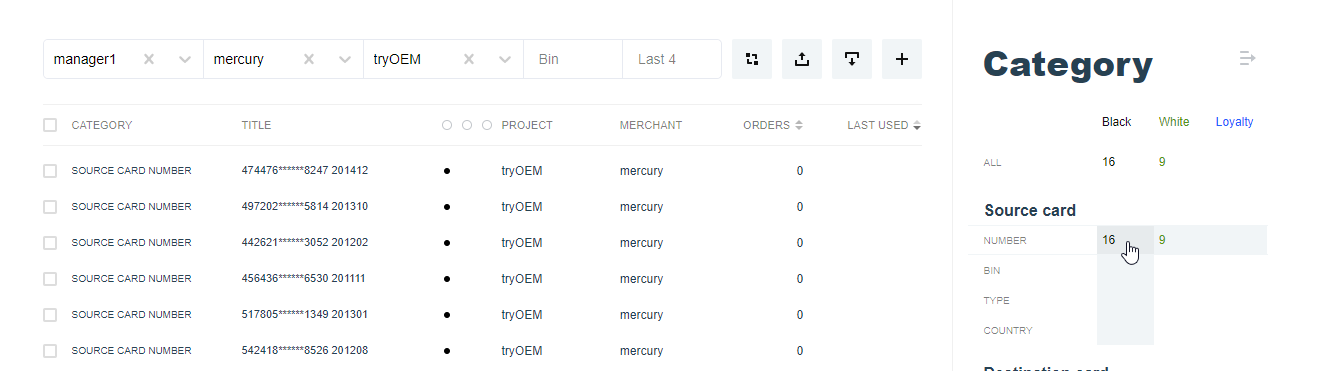

In order to select entries from list, specify manager and merchant/gate/processor for corresponding lists from dropdown menu.

You can also select to show only 1 category from a certain list by clicking it in Category list to the right.

Lists are being checked while processing the transaction when the respective filter gets applied.

Lists are being checked while processing the transaction when the respective filter gets applied.- Processor lists will be available for choosing only after you set up gate with this processor in Project Strategy/Balancing Beta. Gate lists are be available after setting up this gate in Project Strategy/Balancing Beta.

5.6.2. Black lists¶

- attribute is in black list

- attribute is not in black list

Before you put the IP address into the black list you should check with the Internet provider what maximal period of IP address denial you can apply. You should also check if the given IP address is in any third-party anti spam systems.

Before you put the IP address into the black list you should check with the Internet provider what maximal period of IP address denial you can apply. You should also check if the given IP address is in any third-party anti spam systems.

5.6.3. White lists¶

- the list of cards which are charged manually by the Merchants

- the list of cards which receive the money in Money Transfer

- the list of cards which are charged manually by the Manager

If the card number is found in any white list the third party fraud control systems’ checks are excluded either.

If the card number is found in any white list the third party fraud control systems’ checks are excluded either.

5.6.4. Loyalty lists (predefined lists of verified clients)¶

- the lists of the cards manually charged be the Manager

- the lists of the clients’ names and email addresses

- the lists of the clients’ names and phone numbers

- data not available

- the attribute is in the loyalty list: negative activity not present

- the attribute is in the loyalty list: returns are present

- the attribute is in the loyalty list: fraud is detected

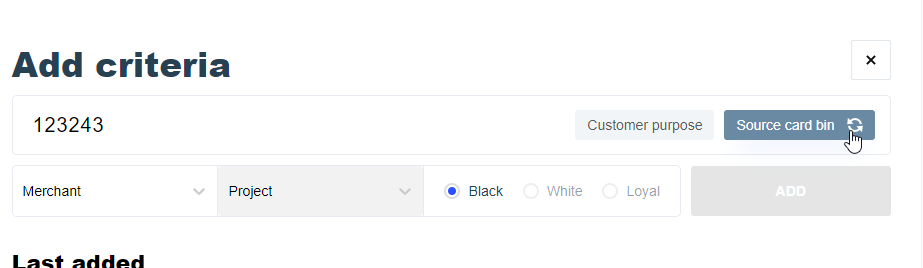

5.6.5. Adding new elements¶

To add new elements, click on the  button. The type of the added criteria will be automatically identified. Ambiguous criteria type can be manually changed, as presented below. You can also use

button. The type of the added criteria will be automatically identified. Ambiguous criteria type can be manually changed, as presented below. You can also use  button to switch between source and destination.

button to switch between source and destination.

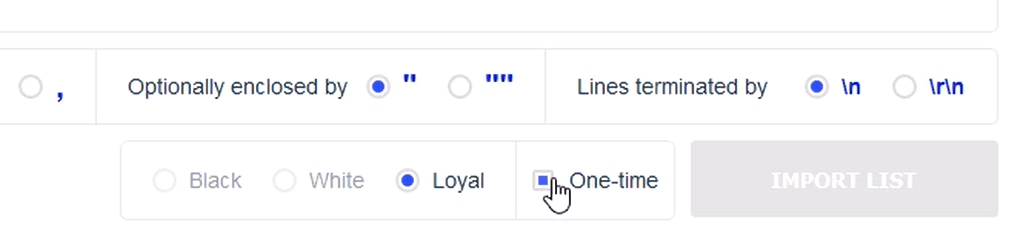

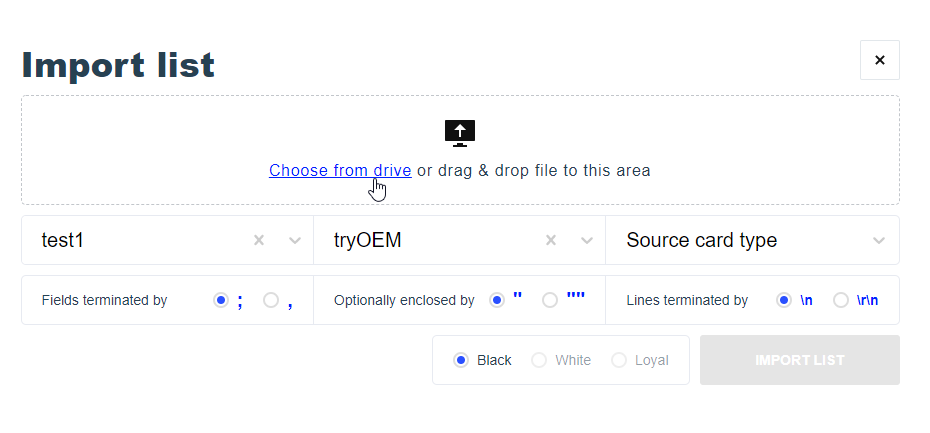

5.6.6. Importing lists¶

import list feature.

import list feature.For example, in order to add card number to list, you should have data on every line in the following order: (5555514066237247,12,2019) and then set delimiter as ‘,’.

In case of disconnect or other technical problems during the process, contact technical support.

In case of disconnect or other technical problems during the process, contact technical support.

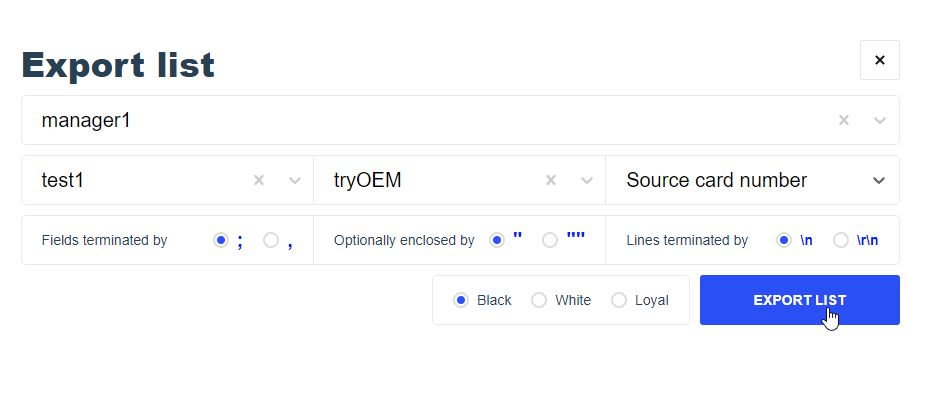

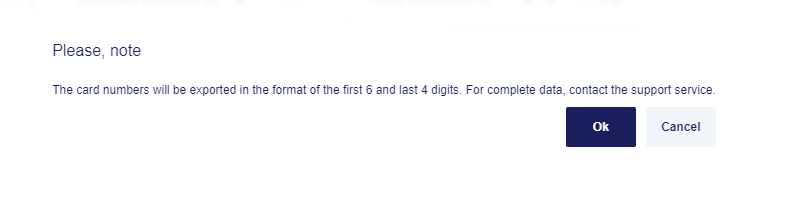

5.6.7. Exporting to file¶

export to file feature.

export to file feature.5.6.8. Synchronizing lists¶

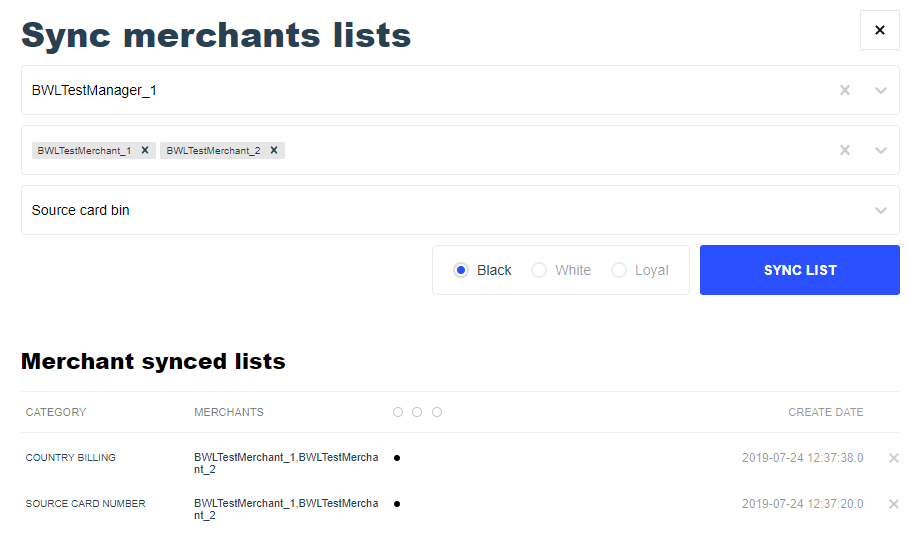

Merchant¶

synchronize list feature. After synchronizing, lists from both merchants will filter transactions as if you joined your two lists.

synchronize list feature. After synchronizing, lists from both merchants will filter transactions as if you joined your two lists. Merchants do not have access to see entries from synchronized lists.

Merchants do not have access to see entries from synchronized lists.

Synchronization can be cancelled by pressing the X button near the synced lists entry.

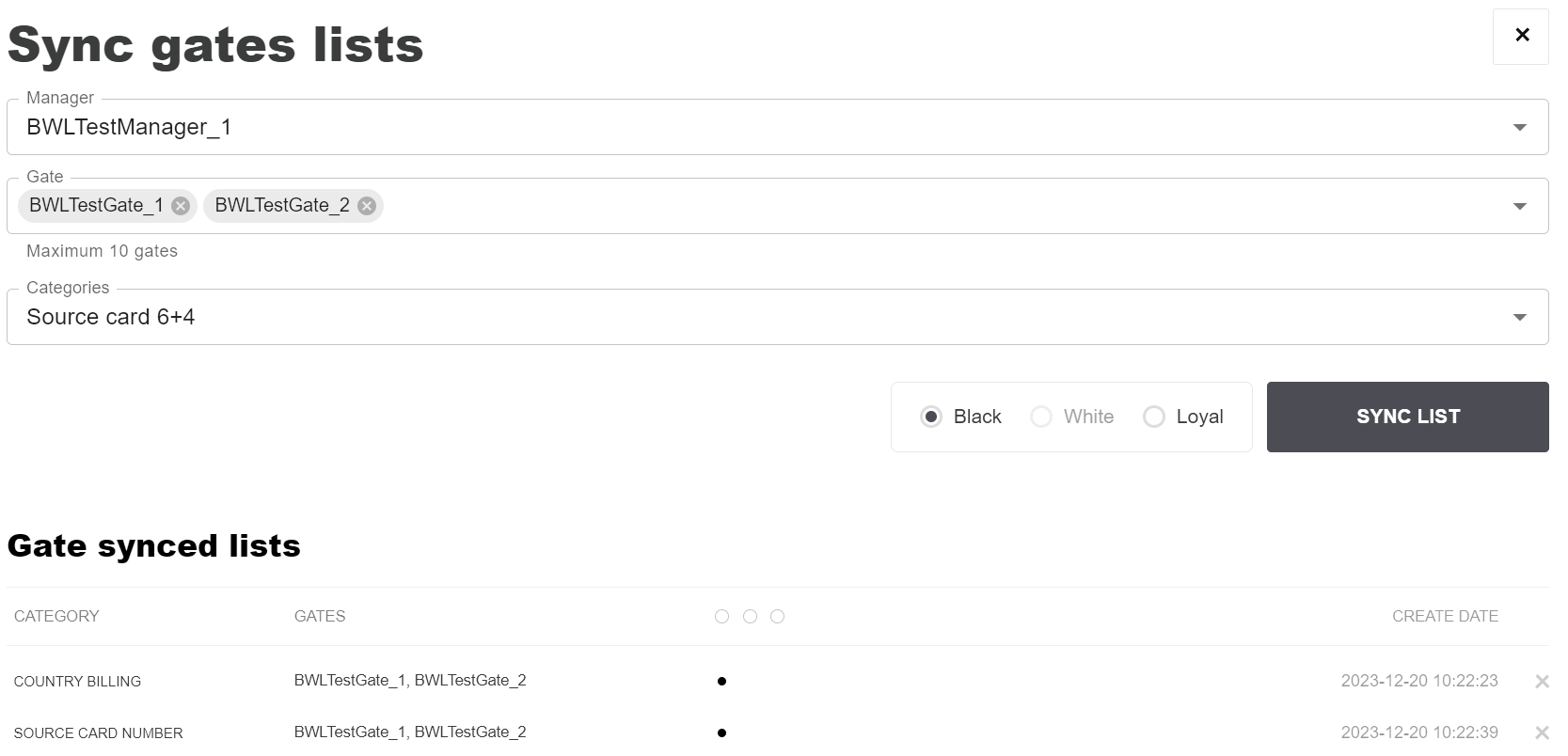

Gate¶

synchronize list feature. After synchronizing, lists from both gates will filter transactions as if you joined your two lists.

synchronize list feature. After synchronizing, lists from both gates will filter transactions as if you joined your two lists. Merchants do not have access to see entries from synchronized lists.

Merchants do not have access to see entries from synchronized lists.

Synchronization can be cancelled by pressing the X button near the synced lists entry.

5.6.9. Error codes¶

- 1039: the card number of the incoming transaction is in the black list(Merchant)

- 1022: BIN of the incoming transaction is in the black list, you are not allowed to manage this list on the Order details screen(Merchant)

- 1079: the “purpose” field of the incoming transaction is in the black list(Merchant)

- 1083: BIN of the receiving party for Money Transfer is in black list(Merchant)

- 1040: IP address of the customer is in the black list(Merchant)

- 1041: The email address of the customer is in the black list(Merchant)

- 1077: the card number of the receiving party for Money Transfer is in black list(Merchant)

- 1160: source card number blacklisted for merchant

- 1147: Billing country blacklisted for merchant

- 1152: Customer purpose blacklisted for merchant

- 1173: Manager loyal customer e-mail check failed

- 1174: Manager loyal customer purpose check failed

- 1175: Manager loyal destination card number check failed

- 1165: Merchant loyal source card number check failed

- 1164: Merchant loyal destination card number check failed

- 1155: Destination card number blacklisted for merchant

- 1148: IP-address country blacklisted for merchant

- 1104: the card number of the incoming transaction is in the black list(Manager)

- 1108: the “purpose” field of the incoming transaction is in the black list(Manager)

- 1105: the card number of the receiving party for Money Transfer is in black list(Manager)

- 1106: IP address of the customer is in the black list(Manager)

- 1107: The email address of the customer is in the black list(Manager)

5.6.10. Available lists for every role¶

| Merchant | Manager | Manager | Manager | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| by Project | by Self | by Gate | by Processor | ||||||||||

| Black | White | Loyal | Black | White | Loyal | Black | White | Loyal | Black | White | Loyal | ||

| Source Card | Number | ||||||||||||

| 6+4 | |||||||||||||

| BIN | |||||||||||||

| Country | |||||||||||||

| Type | |||||||||||||

| Destination Card | Number | ||||||||||||

| 6+4 | |||||||||||||

| Bin | |||||||||||||

| Country | |||||||||||||

| Type | |||||||||||||

| Country | Billing | ||||||||||||

| IP-Address | |||||||||||||

| Customer | Purpose | ||||||||||||

| IP-Address | |||||||||||||

| DNA | |||||||||||||

| Other | E-mail domain | ||||||||||||

| E-mail + Source Card last 4 | |||||||||||||

| E-mail + Source Card number | |||||||||||||

| E-mail + Source Card 6+4 | |||||||||||||

| Customer Phone + Source Card number | |||||||||||||

| Purpose + Source Card number | |||||||||||||

| DNA + Source Card number | |||||||||||||

5.6.11. Comments¶

5.6.12. Country and state codes¶

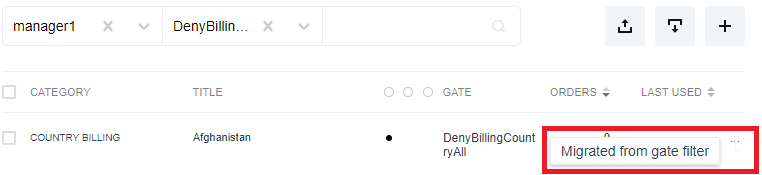

5.6.13. Order details: configuring BWL lists¶